Next, you need your bank accounts and credit cards. I would suggest names such as “Wells Fargo Checking” or “BOA Savings” or “Fidelity Investments” or “BB&T Credit Card.” These names list both the name of the banking institution and what type of account it is. It would be best to list every type of bank account and credit card, but it is understandable if you need to list “Other Credit Cards” or “Other Bank Accounts”. Just be sure to keep these two types of accounts separate. A bank account has money in it already that can be spent. Savings and investment accounts also fall into this category. A credit card, however, is an account that is spent first and then paid off.įinally, you need your expense accounts. If income is money entering the system, expenses are the various exit doors. It is best to find a good middle ground for labeling your various expenses. For example, you can label “Gas,” “Car Insurance,” and “Maintenance” as three separate accounts or you can use the label “Automobile” to describe all three or you can use the term “Transportation” to describe all automobile expenses plus the money you spent on mountains of food for your 2-ton ancient psychic tandem war elephant. Step One: Choose Your AccountsĪccounting is primarily focused on maintaining accounts as separate boxes for money to either be debited into or credited out of. Before you can start sorting your money into these boxes, you need to label ALL of them starting with “Income” or “Revenue”.Įvery small or large business or small or large individual who has money to manage, has a means of income or revenue. There has to be a way for money to come into your system whether it be from paychecks, Ma & Pa, or stolen lunch money. In my personal system, I keep separate labels for “Gifts” and “Paychecks.” “Paychecks” is my term for the money that I earn through the sweat of my brow (including tax returns) and “Gifts” is my term for money that I did not earn but was given to me (or violently extorted as is the case with stolen lunch money).

#Excel bookkeeping how to

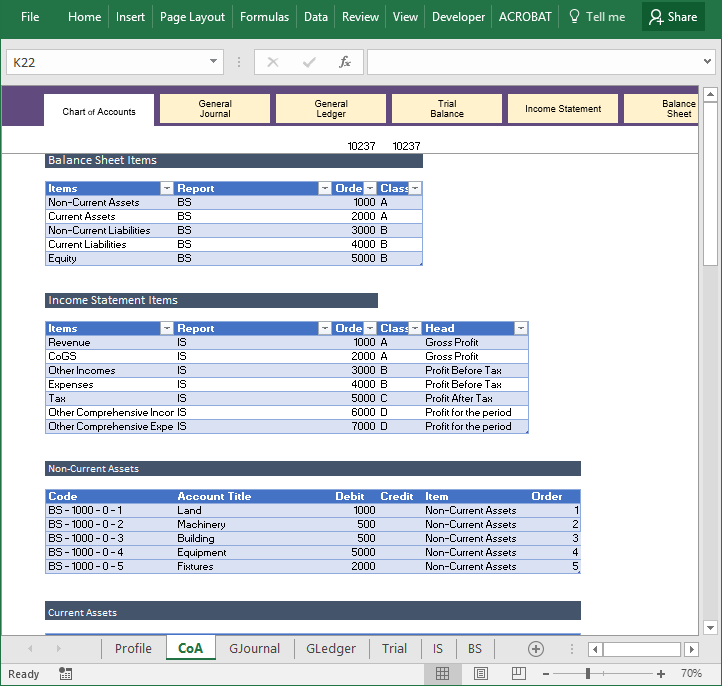

In college, I learned about these concepts and immediately wanted to apply them to my own personal finances. But all I had was Microsoft Excel. Turns out, Microsoft Excel is all you need. In this article, I will detail how to create double-entry bookkeeping system in Excel that will help you keep your money sorted just like a good accountant. What is Double-Entry Bookkeeping and Why Should You Use It?ĭouble-Entry Bookkeeping is the system used in accounting to ensure that every transaction tells an accurate story about where the money came from and where it went. It is a bit similar to Newton’s Third Law. This is the physics concept of every action having an equal and opposite reaction. The accounting principle behind the double-entry system states that for every debit to one account there is an equal credit from another account. The money had to have come from somewhere and gone into somewhere. In basic accounting practices, where the money came from is considered a credit and where the money goes is considered a debit.

0 kommentar(er)

0 kommentar(er)